CNBC: Feb. 23rd 2015

"After years of underperforming the market, hedge funds have gotten hot on stocks. Allocations in the $3 trillion industry have turned to their most bullish positions ever"

"hedge funds again are hitching their hopes to Apple"

"fund managers have increased bullish positions on the Nasdaq index at the "strongest pace in more than a year."

ALL IN Visualized: Rydex asset allocation

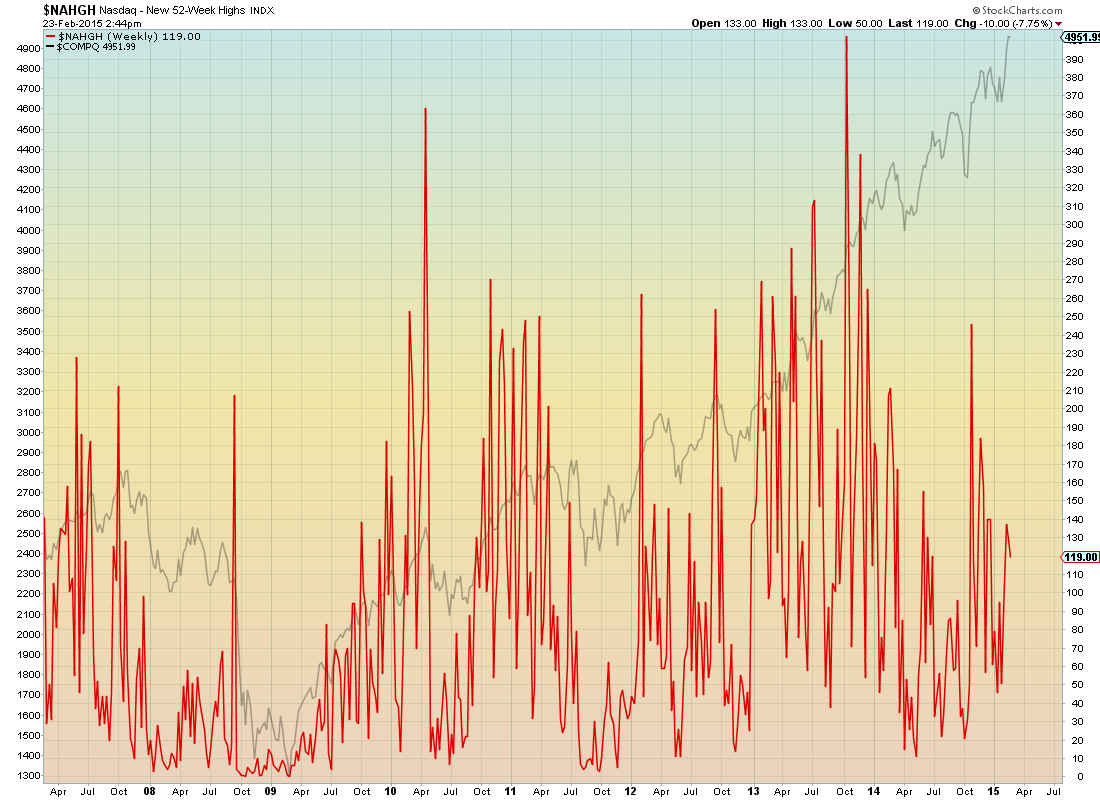

Nasdaq New 52 week Highs Lies

WAY back in Y2K, Cisco was the most valuable company in history with a market cap of $500 billion+. Now, it's worth $150 billion. Fast forward and Apple is now the most valuable company in history, with a market cap of $770 billion. Since January 2nd, Apple's market cap has increased by $150 billion - i.e. one Cisco added in 7 weeks.

"One trillion dollars. That's how much at least one analyst believes Cisco Systems Inc. will be worth in a few years--and you'd be hard pressed to find anyone to disagree."

Unfortunately, 69% of Apple's revenue comes from the iGadget du jour aka. the latest Crackberry

w/Nasdaq in background:

This is the set-up we've been waiting for, but as is wholly necessary prior to collapse, no one is around to see it. There's no shorting subprime now, so from a Wall Street point-of-view this will make 2008 seem like a fucking picnic.

Too bad the sheeple have to get fleeced all over again by the same psychopaths as last time. And the time before...

Too bad the sheeple have to get fleeced all over again by the same psychopaths as last time. And the time before...