The Fed's view on deflation: "All forward decks are now open for swimming"

BI: Sept. 24, 2015

"Have No Fear, The Titanic Is Well Anchored"

Having nothing better to do, I just read Janet Yellen's speech from Thursday evening regarding Monetary policy and "inflation dynamics". Suffice to say with logic like that, who needs enemies?

"In summary...I expect that inflation will return to 2 percent over the next few years as the temporary factors that are currently weighing [down] inflation wane, provided that economic growth continues to be strong enough to complete the return to maximum employment and long-run inflation expectations remain well anchored. Most FOMC participants, including myself, currently anticipate that achieving these conditions will likely entail an initial increase in the federal funds rate later this year, followed by a gradual pace of tightening thereafter"

The Fed's rate projections (via the Dot Plot) aka. Deathstar 2.0 implosion sequence...

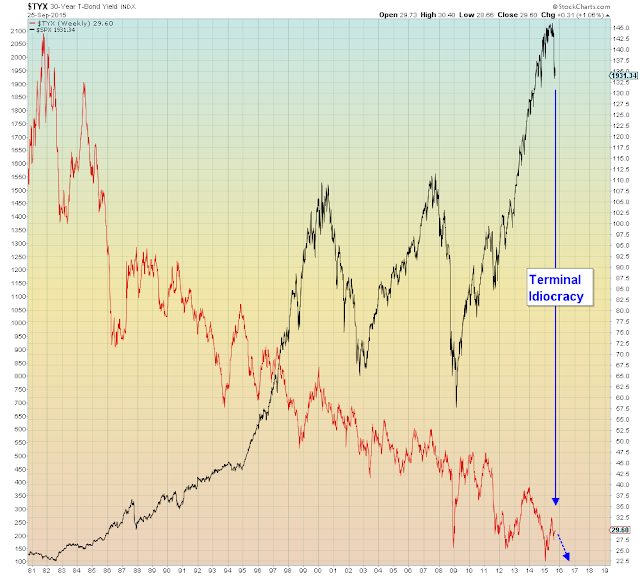

Fed Funds Rate (black) with U.S. Deflation via the Treasury Inflation Protected ETF (red):

"We need to raise rates soon, before stocks get out of hand..."

"continuing to hold short-term interest rates near zero well after real activity has returned to normal and headwinds have faded could encourage excessive leverage and other forms of inappropriate risk-taking"

Global RISK OFF Visualized:

To paraphrase Yellen's speech, my comments in brackets...

"Inflation is caused by monetary and structural factors. During the 1970s, both Monetary and structural factors led to stagflation..."

['Structural factors' aka. 'Middle Class']

"Subsequently, inflation has trended lower for 35 years straight" [as the Middle Class has been decimated]

"For some unknown reason [aka. Globalization], Monetary policy is no longer having any impact on the economy, so inflation is no longer 'always and everywhere a monetary phenomenon'"

"Therefore, ignore this chart (below), which we've been using since the 1960s to guide policy. Because, we expect inflation to remain magically 'anchored' at 2%, [since we have to pretend that we still have control over the Titanic]"

Deflation is "anchored" to this downtrend:

Ignore capacity utilization (below) as well, which gives the all-too-obvious explanation for why inflation (deflation) is trending ever-lower:

In a nutshell, the middle class was the transmission mechanism for Monetary policy, however, since the middle class no longer exists, Monetary policy is no longer working.

Walmart destroyed small business and now Amazon is destroying Walmart. Because "we can no longer afford wages"...

Treasury Bonds don't give a shit about Fed speeches...