Given that U.S. economic policy is predicated upon sheer fantasy, it's apropos that Netflix is spending billions of non-amortizing debt on new binge watching content. It's a corporate ponzi scheme built on top of a U.S. ponzi scheme, built on top of the Globalized ponzi scheme. Asinine assumptions resting upon even greater asinine assumptions. Wall Street estimates can be located under science fiction...

Netflix is bid after-hours on news that it will burn $4 billion in cash this year, assuming it has continuous unfettered access to credit markets to fund Ponzi growth. If not, the stock will promptly go to zero. In other words, it's a massive call option on indefinite economic expansion. Which expires with zero notice.

More than any other stock, perennial high-flyer, Netflix, epitomizes the smoke and mirrors behind today's Ponzi economy. It's a company attempting to borrow its way out of debt by borrowing ever-larger sums of money to fund fake growth. A non-amortizing leap of faith on perpetual Ponzi growth. Meaning it resembles the U.S. Treasury.

"The Congressional Budget Office last Monday released a report that for the first time officially projected the federal deficit rising to almost $1 trillion in 2019 and then staying at or well above that previously unfathomable level every year through 2028."

But, in reality, it's far worse than that, because like all good Ponzi estimators, today's EconoDunces took the second largest expansion in history and projected it out forever. They never take the possibility of recession into account. Therefore, CBO estimates of trillion dollar deficits for the next decade, are the best case scenario.

Here are their assumptions:

Baseline scenario:

"Potential output is projected to grow more quickly than

it has since the start of the 2007–2009 recession"

Worst case scenario:

"CBO projects a soft landing for the economy—in which

the output gap closes through slower, but still positive,

economic growth—but there is nevertheless a risk of

recession. That risk does not stem from the duration of

the current economic expansion, even though it has lasted

more than eight years—longer than the average"

They threw that last part in there just so we would know for certain they're idiots. In case we had any doubt.

The punchline has to be this:

"The largest effects on GDP over the decade stem from the tax act."

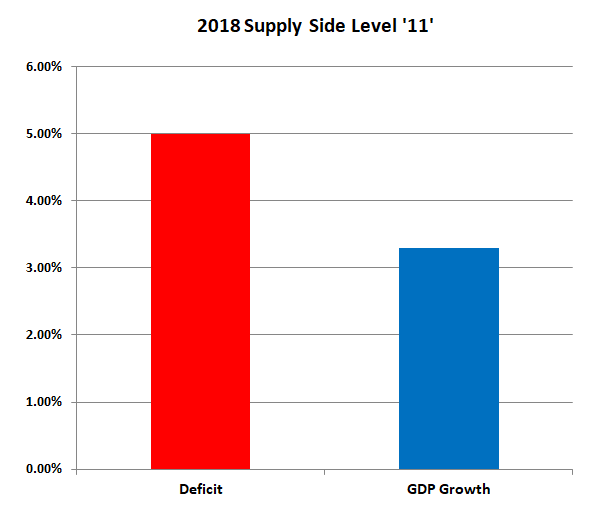

The truth of course - as it has been since Reagan - is that the primary effects on GDP are from the resulting deficit itself. The obligatory conflation of debt as GDP. Supply Side dumbfuck-o-nomics at level '11':

The punchline has to be this:

"The largest effects on GDP over the decade stem from the tax act."

The truth of course - as it has been since Reagan - is that the primary effects on GDP are from the resulting deficit itself. The obligatory conflation of debt as GDP. Supply Side dumbfuck-o-nomics at level '11':

If this is correct, then it confirms what the big banks said last week - that the tax cut "plink" was 100% con job, as CBO estimates for GDP in 2018 are already off course. To say nothing of the coming decade.

They're already wrong one week into their fucking projection.

All of which means that Netflix and by extension the S&P 500, is a Ponzi delusion built on top of an even bigger economic Ponzi delusion. A call option on the non-amortizing status quo.

Right now, every investment advisor is assuring their clients that stock market valuations are reasonable. Just as they were doing in 2007:

And Netflix is once again exhibiting the power of imagined realities